With a Traditional IRA account, you can contribute your pre-tax dollars and watch your investments grow tax-deferred until distribution (withdrawal).

Account Types

To fit your needs, you can open a Traditional IRA Savings or Certificate account.

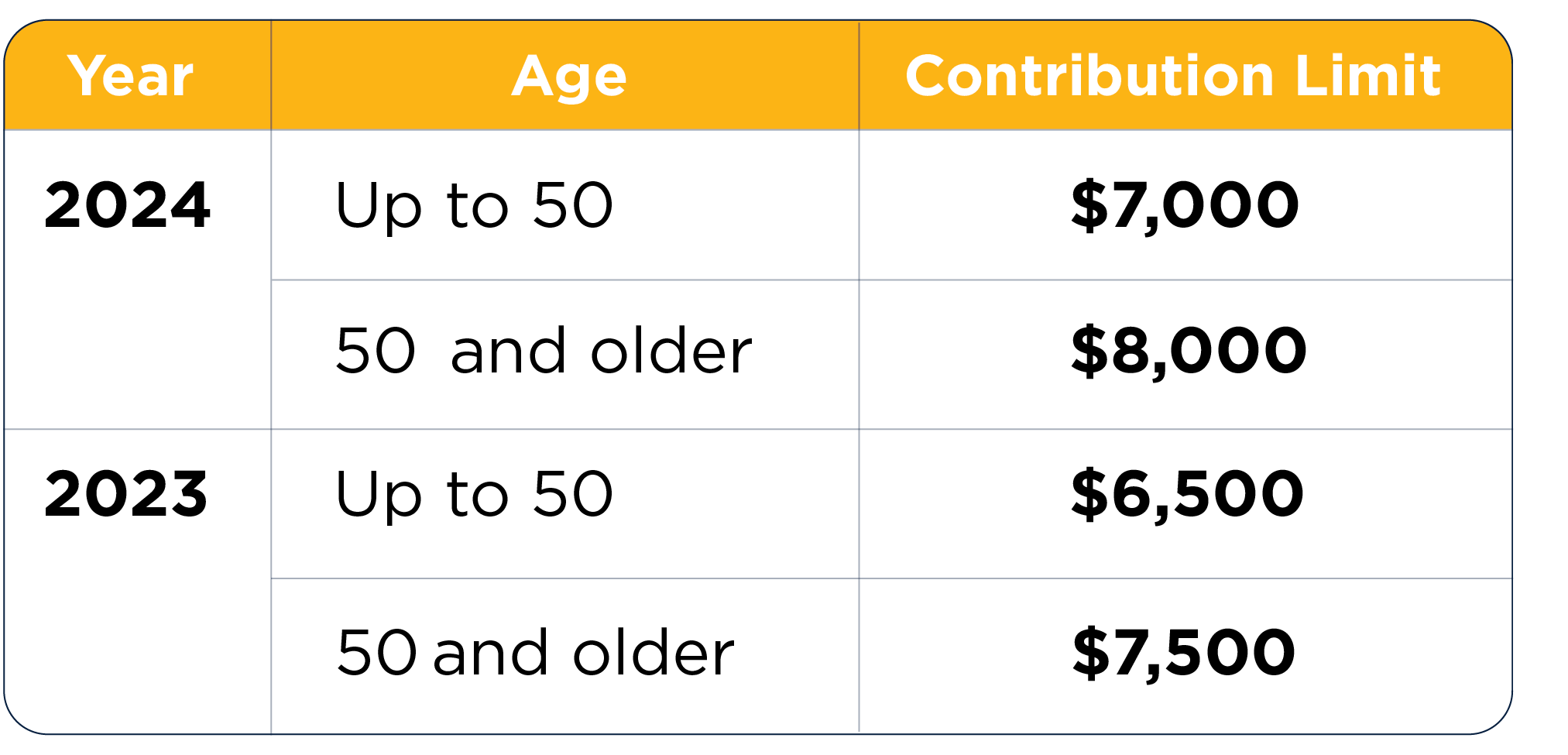

Contribution Limits

Catch-Up Contributions

Individuals who turn age 50 and older can make a catch-up contribution of $1,000 per tax year in addition to regular contributions. This catch-up contribution may also be made to an IRA for a non-working spouse.

Rollovers

You can roll over a traditional individual retirement account if you retire or change jobs and receive a lump-sum distribution from a qualified pension (i.e., 403B, 401K) plan. You can roll over all or any part of these funds into a tax-deferred IRA rollover account. You must make this rollover within 60 days from the day you receive your lump-sum distribution.

Transfers

You also have the option of transferring your IRA from another financial institution to us. We will handle all the necessary paperwork at no cost to you.

Visit the branch nearest you, or call (800) 341-4333 ext. 6780.

*Consult your tax advisor.

Please refer to the Internal Revenue Service (IRS) for further information concerning deductions and general tax information.