Fraud Prevention Best Practices

Ensuring the safety of your personal information is a top priority at Teachers Federal Credit Union. With the rise of sophisticated fraud tactics, we want to provide you with best practices to safeguard your accounts.

Be cautious of unsolicited phone calls, emails, or text messages, and remember to never share your personal information. Teachers Federal Credit Union will NEVER contact you directly to request any of your account information, including:

- Social Security Number

- Credit or Debit Card Numbers

- Security Code or CVV

- PIN - Personal Identification Number

- Home or Billing Address

- Date of Birth

- Online Banking Login Information

- Verification Codes

- Passwords

- Driver License Number

Recognize and Avoid Scams

- Fraudulent Websites: Fraudulent websites can often appear authentic, making it essential to exercise vigilance when entering login credentials or personal information online. Make sure to check the website address for any spelling inconsistencies or irregularities. If any doubts arise regarding the website's validity, refrain from providing personal information and promptly exit the site.

- Phone Call Scams: Before responding to any requests for information via telephone, validate that the call is legitimate. If uncertain, terminate the call and initiate a callback using the company's official telephone number as indicated on a statement, receipt, or verified website.

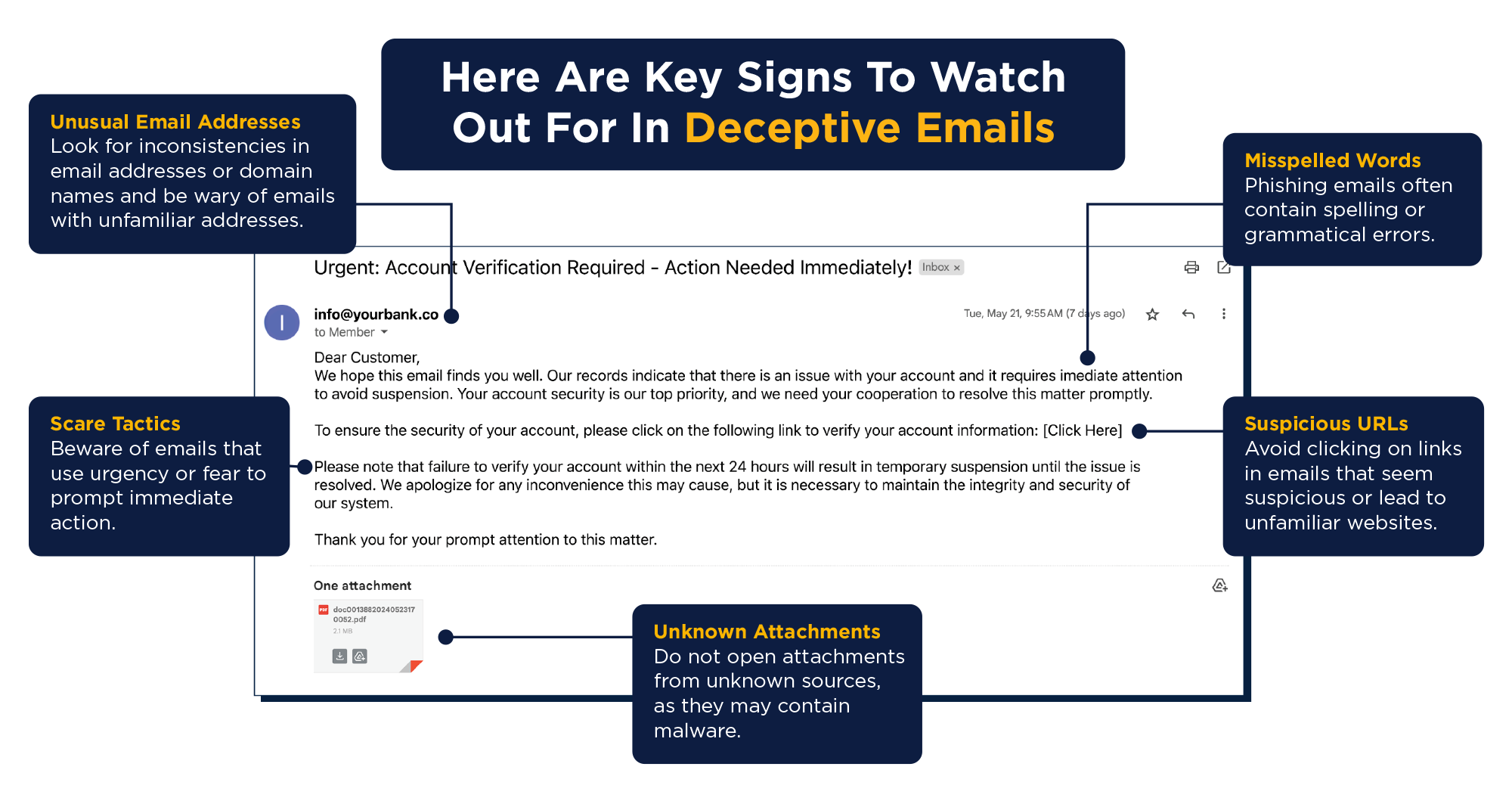

- Email Scams (Phishing) or Text Message Scams (Smishing): Avoid clicking on any links or downloading attachments within questionable emails or texts. Check unsolicited messages for misspellings and validate the sender’s address matches the company it is coming from. If you receive a suspicious email or text, forward it to phishing@teachersfcu.org.

Keep Personal Information and Finances Secure

- Use Teachers Online Banking or the Teachers Mobile App to help track your spending and accounts. Never give another person access to Online Banking or share your credentials.

- Switch to eStatements for secure access to your financial information and eliminate the risk of physical mail interception. Enroll through Teachers Online Banking.

- Regularly review your account activity to detect any unauthorized transactions.

- Enable multi-factor authentication to add an extra layer of security.

- Regularly update your passwords to strengthen your account protection.

- Utilize Card Valet to set up your cards for transaction notifications and location restrictions.

- Obtain a copy of your free annual credit report from any of the three credit bureaus (Equifax, Experian, TransUnion) by visiting annualcreditreport.com.

Stay Vigilant Against Common Scams

You can find more information about common fraud and scams, as well as resources for dealing with fraud, in the links below:

To report suspicious phone calls, texts, or emails, or if you need additional assistance, please contact Teachers at 1-800-341-4333 or email us at phishing@teachersfcu.org.